Northside Down Payment Assistance

Program Guidelines

In order to qualify for Northside Down Payment Assistance, you much meet the following requirements:

First-Time Homebuyer status

You must be a First-Time Homebuyer

Income Limits

Total household income at or below 80% AMI ($63,250 for a family of four in 2023)

Assistance Limits

Up to $50,000 based on need and availability

The amount of funds will be contingent on buyers’ mortgage, financial situation, and need. Need is determined as the home value (lower of appraisal and sale price) plus closing costs, minus maximum mortgage pre-approval, minus all other down payment assistance available.

Funds will be awarded on a first-come, first-serve basis.

Secure a fixed rate mortgage

Monthly mortgage payment must be affordable at 35% of monthly income (up to 40% based on buyers’ demonstrated ability to pay. For example, if rent was higher than mortgage).

Attend 8-hour First-Time Homebuyer workshop

First mortgage lender completes the Lender Application Checklist

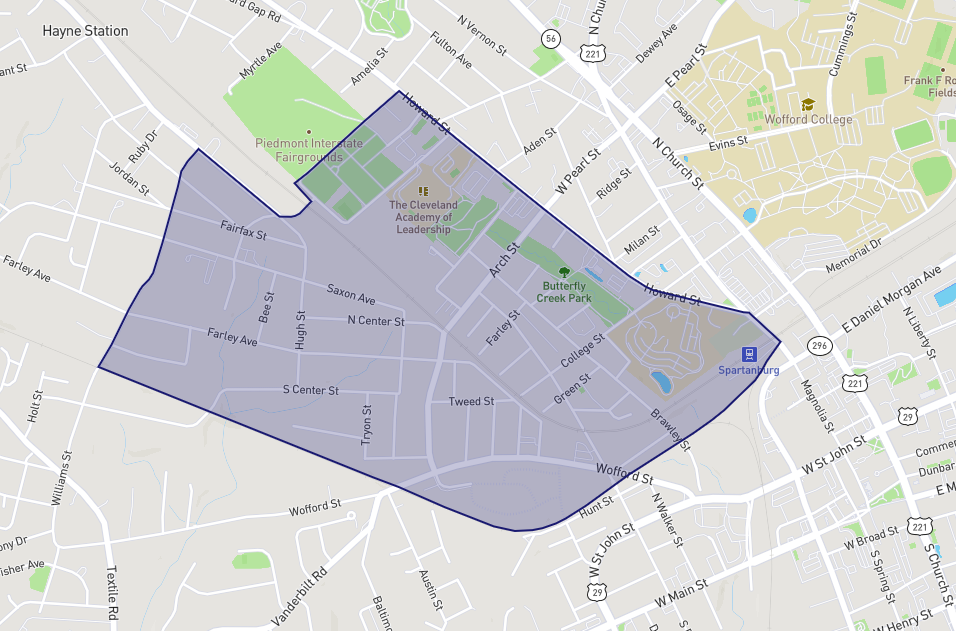

Purchase a home in the Northside Neighborhood to be used as their primary residence

Documentation

Down Payment Assistance Pre-approval Letter

This letter will be sent by a Carolina Foothills FCU Mortgage Loan Officer, letting you know whether you qualify for Northside DPA.